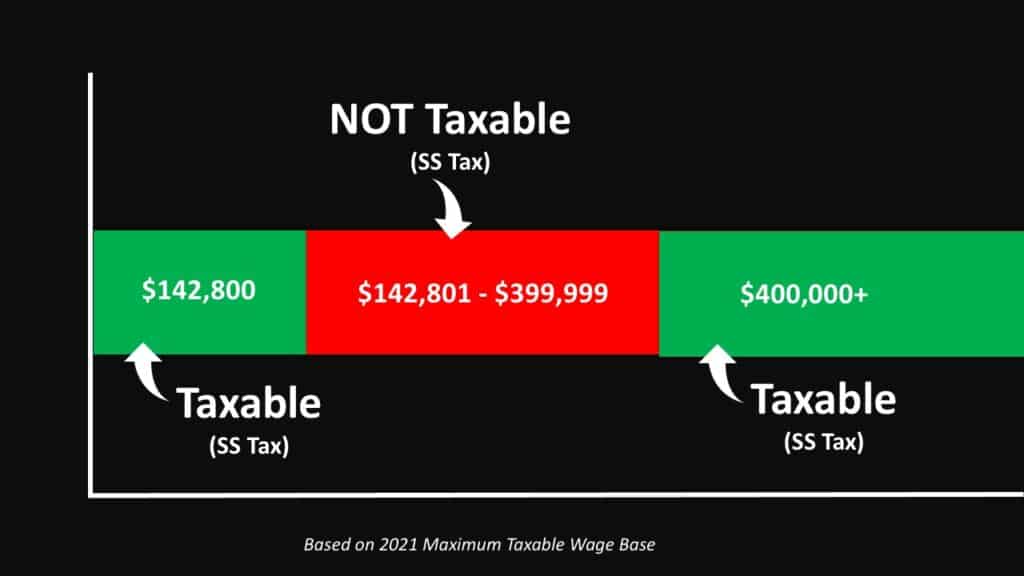

Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Social Security wage base is $160,200 in 2023, meaning more FICA

Capital Gains Tax Explained: What It Is and How Much You Pay

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

Understanding FICA Taxes and Wage Base Limit

What are the major federal payroll taxes, and how much money do

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

The Myth of Fixing Social Security Through Raising Taxes – Social

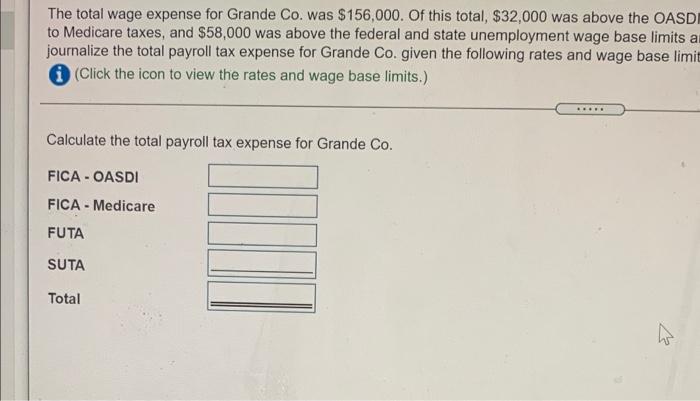

Solved The total wage expense for Grande Co. was $156,000.

What is Self-Employment Tax? (2022-23 Rates and Calculator)

Minimum Wage and Overtime Pay, FICA

Understanding Your W-2

How An S Corporation Reduces FICA Self-Employment Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)