FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

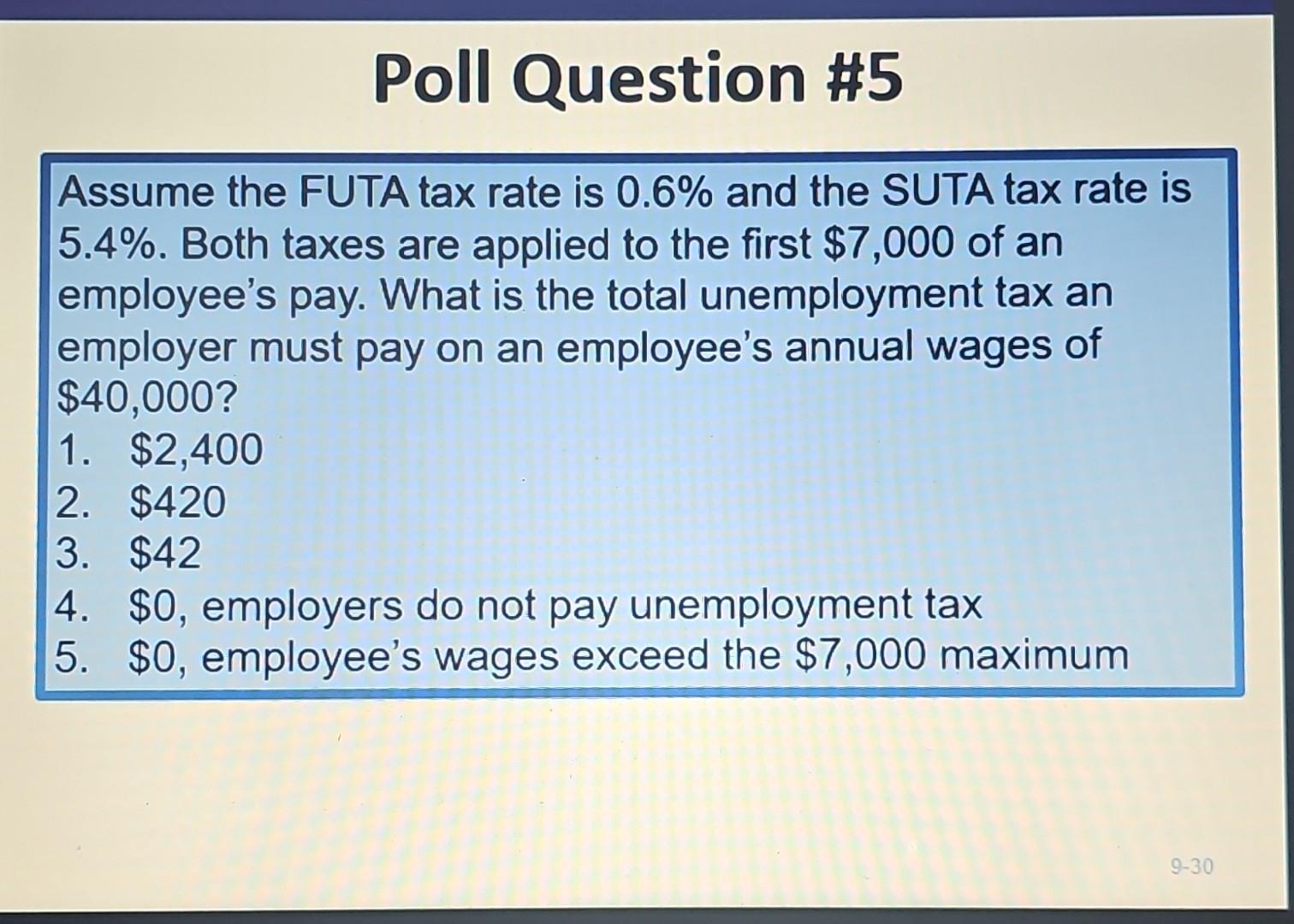

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

7 Steps to Starting an LLC in North Carolina - NerdWallet

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

What Is FICA Tax: How It Works And Why You Pay

What are FICA Taxes? 2022-2023 Rates and Instructions

Driving progress at NerdWallet — and beyond - NerdWallet

Document

Self-Employed Health Insurance Deductions

Solved An employee earned $50,000 during the year. FICA tax

Estimated Tax Payments 2023: How They Work, When to Pay - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)