Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Descrição

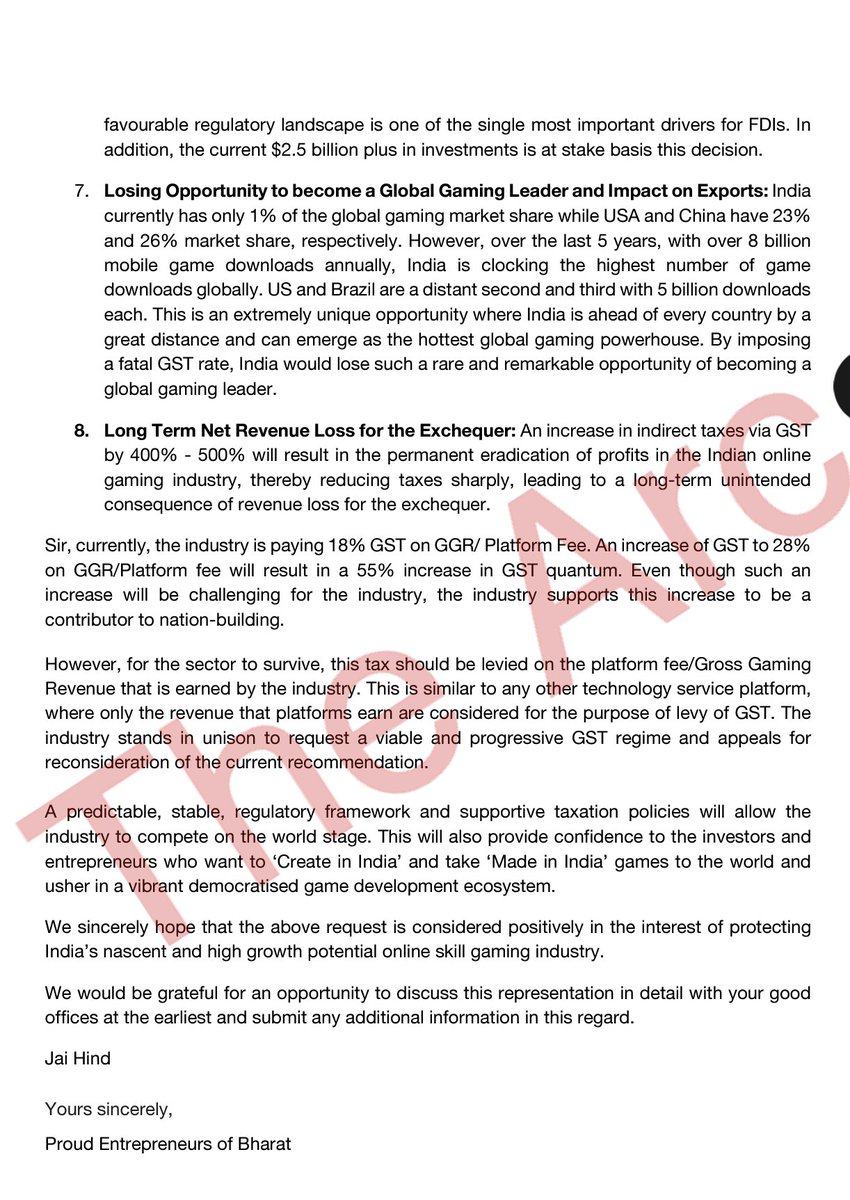

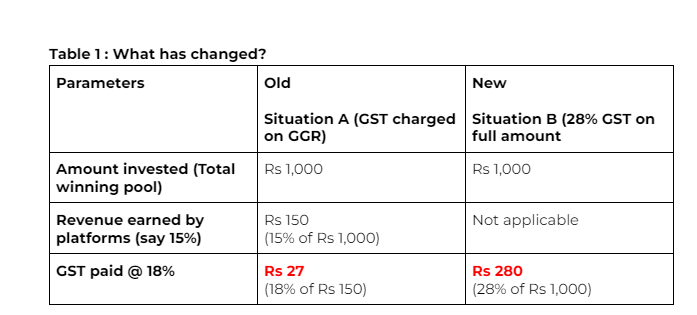

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

gst: Online gaming companies seek more clarity on GST - The

From Loot Boxes to Tax Boxes: Unpacking the aftermath of tax hike

Countries With Thriving Online Gaming Industry Levy GST On Gross

Online gaming industry for 28% GST on gross gaming revenue not on

India deals a 28% tax blow to online gaming industry

The GST council today announced levying 28% taxes on online gaming

The Online Gaming Industry Attracts 28% GST On Gross Gaming

Unpacking the online gaming and gambling GST saga

Industry rancorous over 28% GST on online gaming. What does it

Explained: Why Are Gaming Companies Being Investigated For GST

RIP - Real money gaming” says online gaming industry over 28% GST

de

por adulto (o preço varia de acordo com o tamanho do grupo)