What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?

Por um escritor misterioso

Descrição

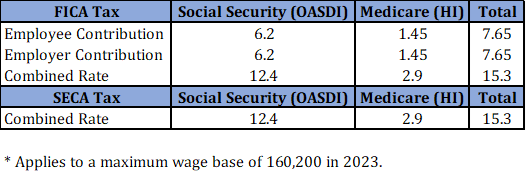

In addition to funding Social Security benefits and Medicare health insurance, the FICA tax (Federal Insurance Contribution Act) is a payroll tax that is split between employees and employers. In addition to 7.65% (6.2% for Social Security and 1.45% for Medicare), they both contribute 15.3% to FICA, which is a combined contribution of 15.3%. Employees can earn up to $137,700 in 2020. Medicare does not have a wage limit.

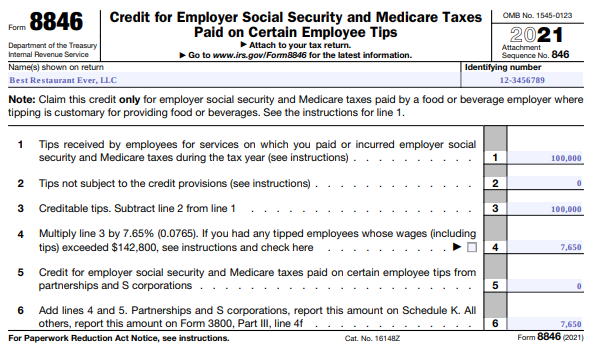

Your Guide To The FICA Tip Credit 2023: How Restaurants Can Save

FICA Tax: Understanding Social Security and Medicare Taxes

Social Security, Medicare & Government Pensions - Legal Books - Nolo

How is self-employment tax calculated?

2023 Guide to Wag! Taxes: Forms, Write-Offs & How to File

How to calculate payroll taxes 2021

Social Security Financing: From FICA to the Trust Funds - AAF

Payroll Taxes: Your Obligations and How to Meet Them

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

What Is FICA?

What is FICA Tax? - Optima Tax Relief

de

por adulto (o preço varia de acordo com o tamanho do grupo)