What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Descrição

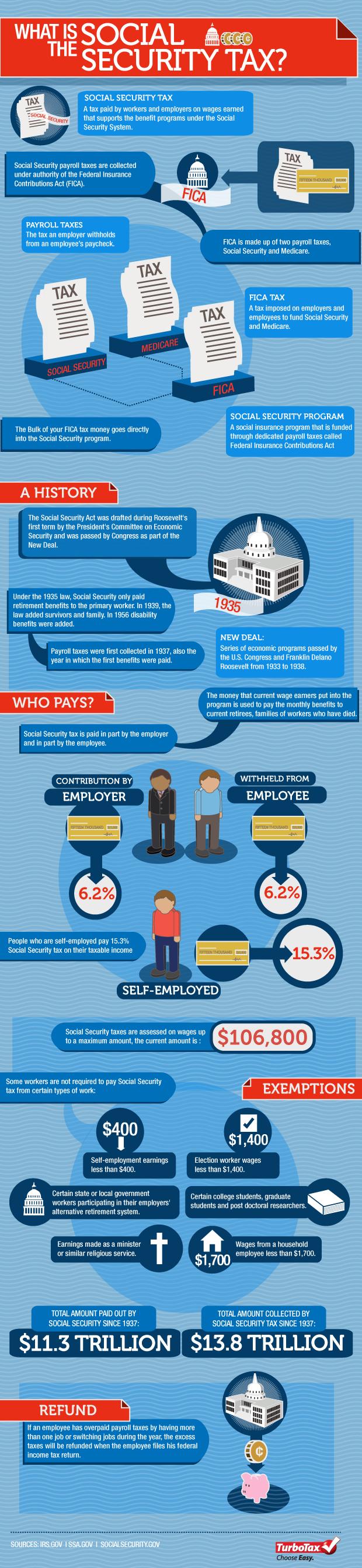

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

What is the Social Security Tax?

W-2 Arrival: All You Need to Know about Tax Forms - The TurboTax Blog

What is FICA Tax? - The TurboTax Blog

What is FICA Tax? - The TurboTax Blog

You May Still Be Eligible To File Your Taxes for Free! - The

Lottery Calculator - The TurboTax Blog

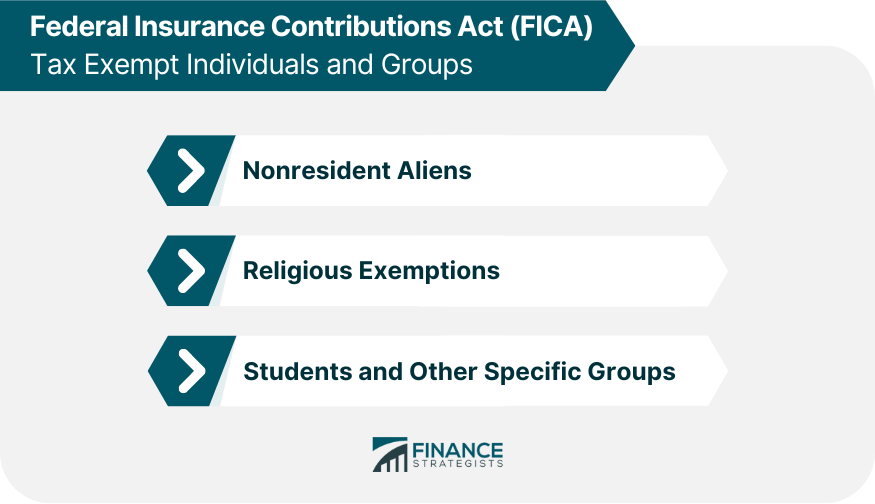

Withholding FICA Tax on Nonresident employees and Foreign Workers

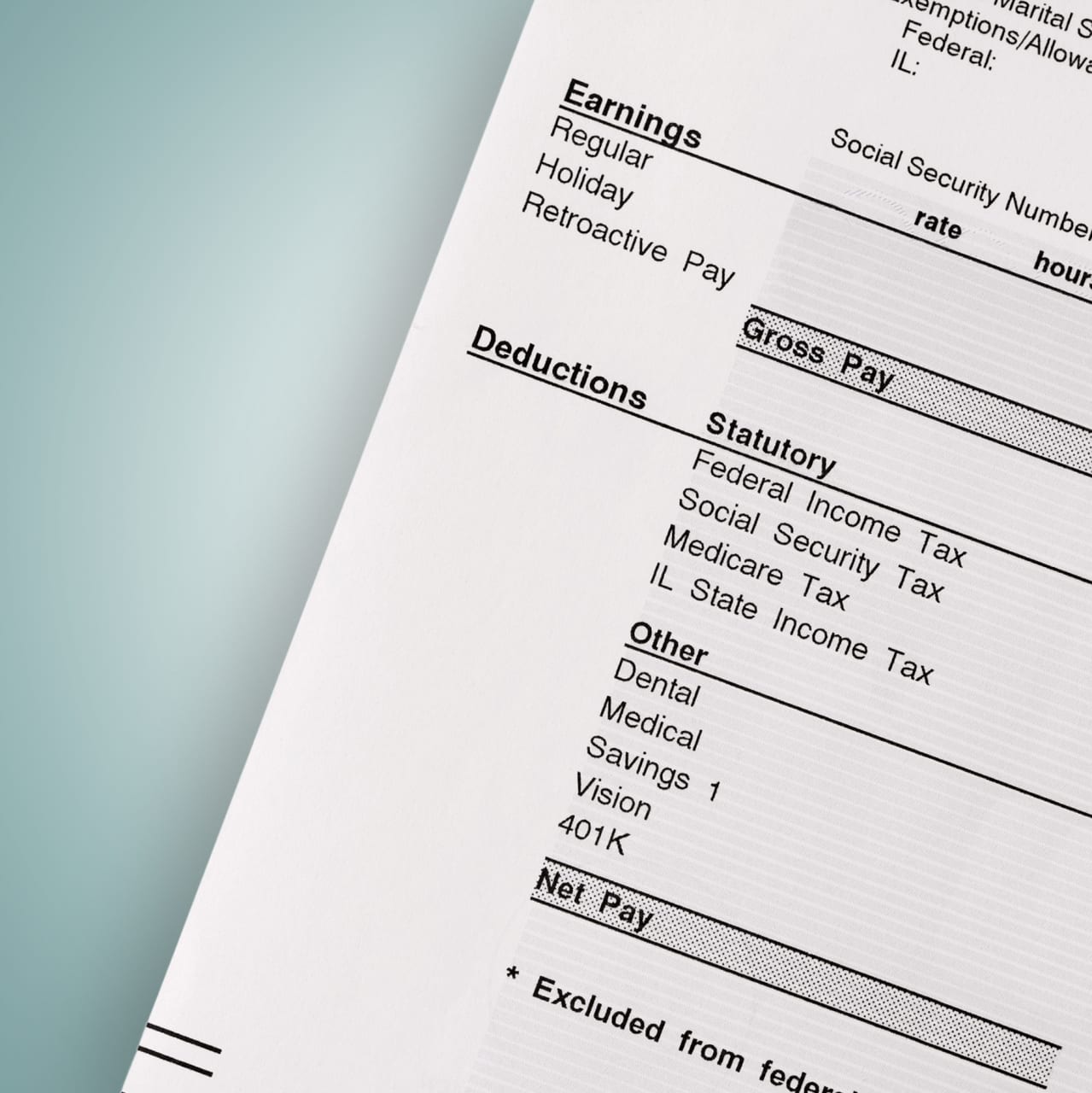

How to Read Your Pay Stub - Buy Side from WSJ

10 Popular Tax Myths Busted by Actress Jenny Lorenzo - The

FICA and Withholding: Everything You Need to Know - TurboTax Tax

2019 US Tax Season in Numbers for Sprintax Customers

IRS Announced Significant Inflation Adjustments for Tax Year 2023

Do Social Security Income Recipients Pay Income Taxes? TurboTax

de

por adulto (o preço varia de acordo com o tamanho do grupo)