Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

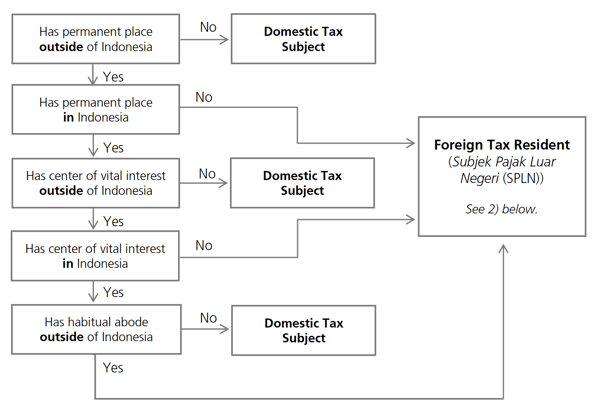

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

BoldenITS – Just another WordPress site

How To Handle Dual Residents: The I.R.S. View On Treaty Tie-Breaker Rules - - United States

Tax Residency Status Modification: Mexican Tax Implication - Freeman Law

Residency Tie Breaker Rules & Relevance

India - The Dilemma Of Dual Residence – Can Vital Interests Fluctuate Overnight? - Conventus Law

%20(2).png)

What To Do If You Satisfy More Than One Country's Tax Residency Test

Updated guidance on tax treaties and the impact of the COVID-19 crisis - OECD

Indonesia's Omnibus Law - Individual Tax Subjects

Who Claims a Child on Taxes With 50/50 Custody? - SmartAsset

Double Taxation Agreements

EXCEPTIONS TO PFIC REPORTING - Expat Tax Professionals

de

por adulto (o preço varia de acordo com o tamanho do grupo)