Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Descrição

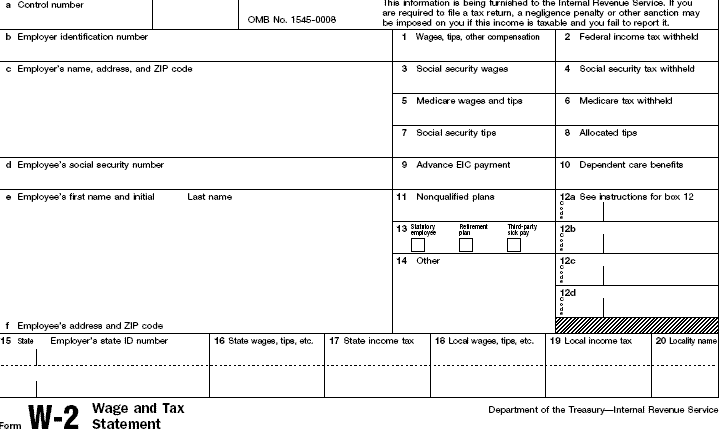

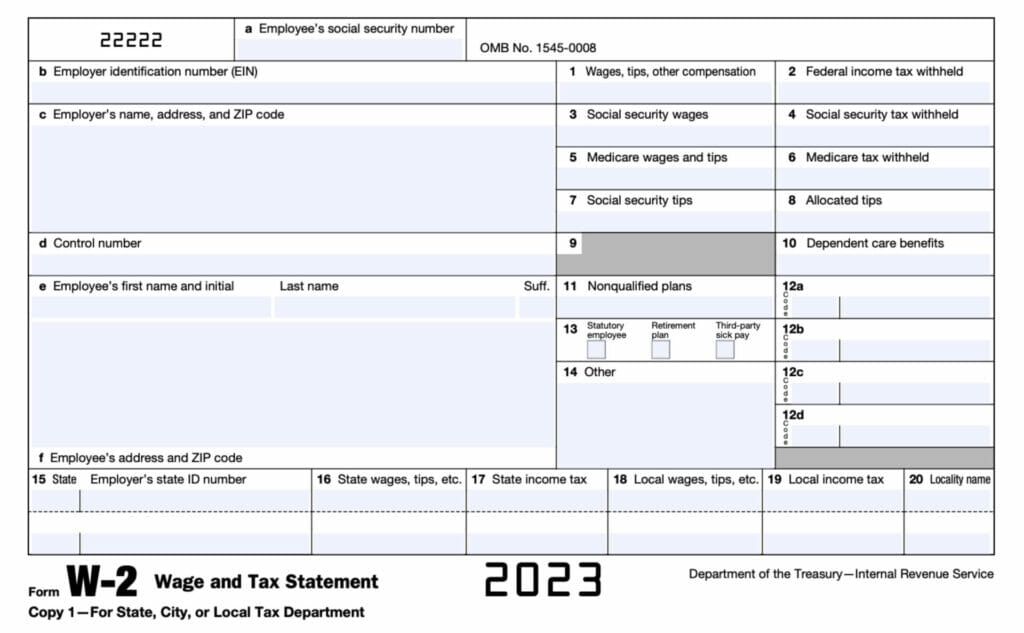

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

What's a W-2? Wage and Tax Statement Explained

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

Paid Family and Medical Leave exemption requests, registration

W-2 vs Last Pay Stub: What's the Difference?

Social Security Administration's Master Earnings File: Background

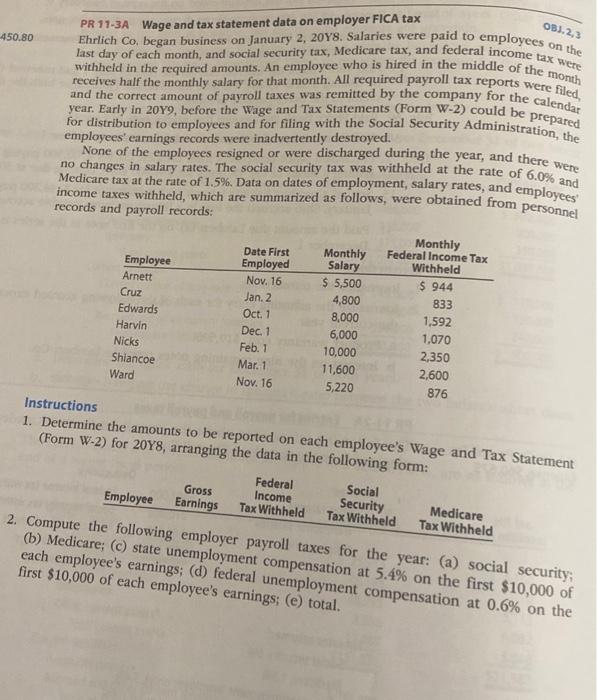

Solved PR 11-3A Wage and tax statement data on employer FICA

Form W-2 Box 12 Codes Codes and Explanations [Chart]

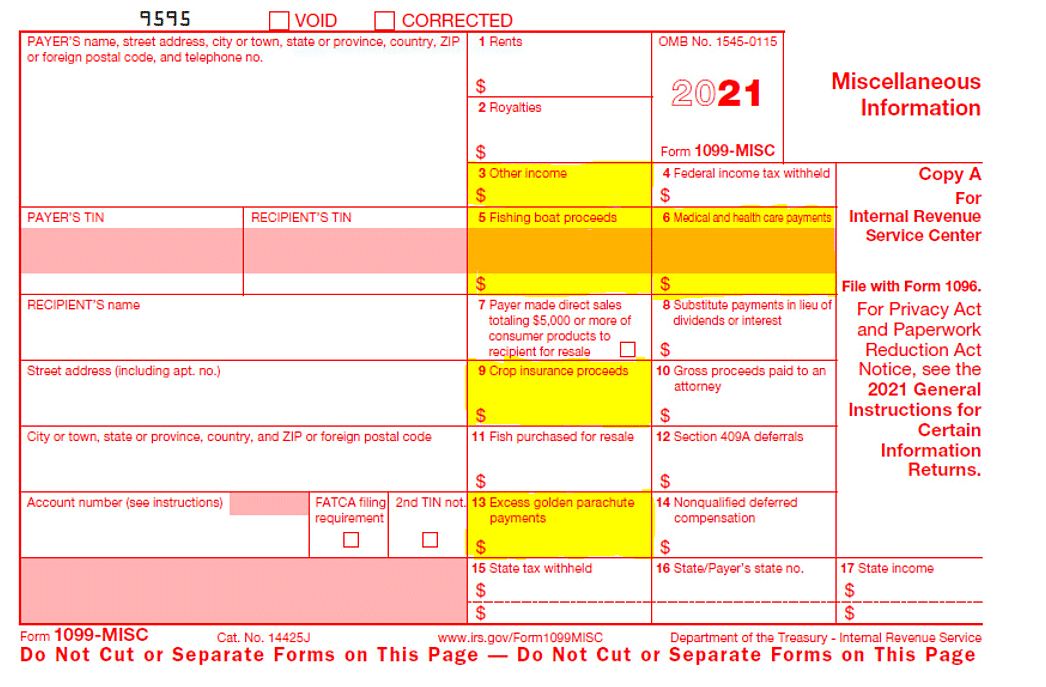

Forms W-2 and 1099 explained for international students & other

What Is the Difference Between Forms W-4, W-2, W-9 & 1099-NEC?

Understanding Your Tax Forms: The W-2

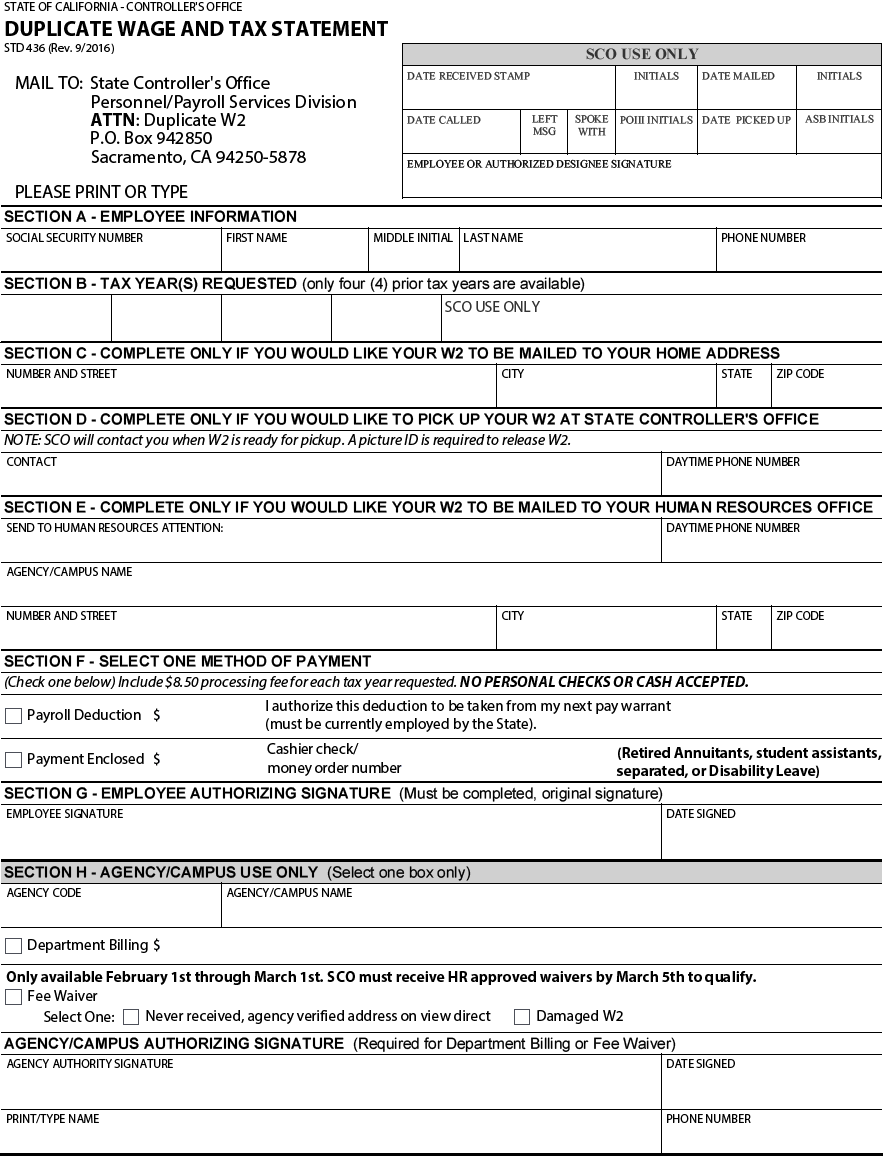

Request a Duplicate Form W-2, Wage and Tax Statement

de

por adulto (o preço varia de acordo com o tamanho do grupo)