Theory of Liquidity Preference Definition: History, Example, and

Por um escritor misterioso

Descrição

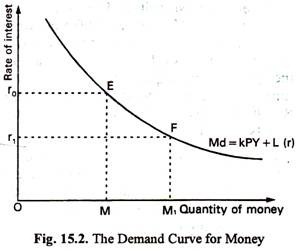

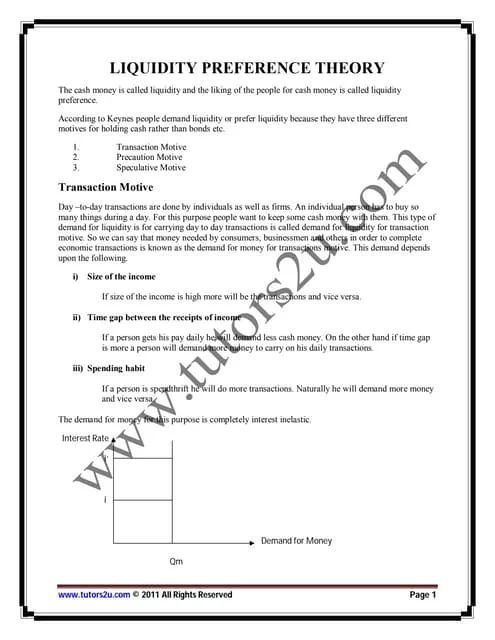

Liquidity preference theory concerns how stakeholders value cash relative to receiving interest over varying lengths of time.

The Liquidity Preference Theory of Interest

Keynes on Monetary Policy, Finance and Uncertainty: Liquidity Preferen

Keynesian Liquidity Preference, PDF, Demand For Money

According to the liquidity preference theory of money, explain what happens when the interest rate is above the level that equates money demand with money supply. Provide a specific example to illustrate

PDF) Liquidity Preference Theory of Interest (Rate Determination) of JM Keynes

PPT - 06-Liquidity Preference Theory PowerPoint Presentation, free download - ID:315363

Worthwhile Canadian Initiative: Teaching Loanable Funds vs Liquidity Preference

:max_bytes(150000):strip_icc()/liquiditytrap.asp_Final-6590b33aa8b54861871f159ddcbf8aac.png)

Liquidity Trap: Definition, Causes, and Examples

Use the theory of liquidity preference to explain why an inc

Bertocco - The Liquidity Preference Theory, PDF, Interest

Solved Case Study Why Central Banks Watch the Stock Market

Liquidity preference theory

de

por adulto (o preço varia de acordo com o tamanho do grupo)