Payday lenders aim to evade federal probes as borrowers plead for

Por um escritor misterioso

Descrição

A powerful set of financial firms have delayed federal investigations or punishments into their allegedly predatory lending practices, as they seize on an industry-led lawsuit challenging the future of the Consumer Financial Protection Bureau. By Tony Romm, October 28 Washington Post

Seen & Heard: AIR's News Roundup Alliance for Innovative Regulation.

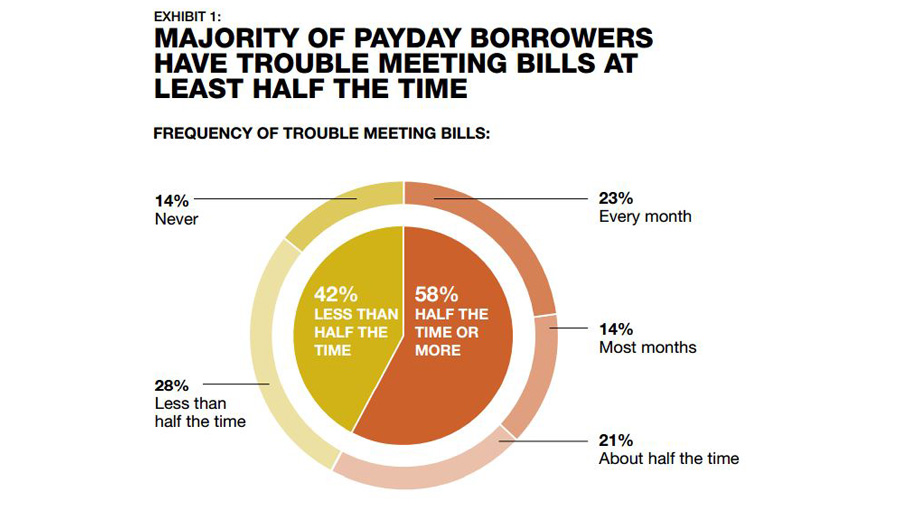

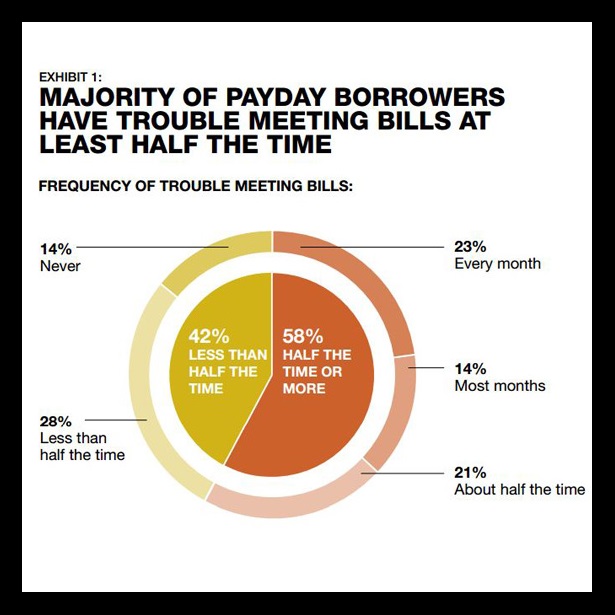

How Borrowers Choose and Repay Payday Loans

N.Y. prosecutors group says former Trump investigator violated ethics with book - The Washington Post

Higher Funding Costs Add Stress While Banks Ready Earnings Reports - BNN Bloomberg

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21818317/payday_loan.png)

CFPB and bank regulators make life easier for payday lenders in the Covid-19 pandemic - Vox

5 things to know for Sept. 21: Strikes, Govt. shutdown, Covid-19, Student loans, Ukraine - KTVZ

BBB Study: Predatory payday loan companies and fraudsters thrive among uneven laws and stolen data

Watch 'Bloomberg Surveillance' Full Show (05/27/2021) - Bloomberg

Confronting the Cost of Trump's Corruption to American Families - Center for American Progress

Payday Lending in America The Pew Charitable Trusts

The Future of the Federal Home Loan Bank (FHLB) System, Explained - Bloomberg

London Payments Firm Moves $1 Billion a Month Despite 'Red Flags' - Bloomberg

Fraud Considerations in Paycheck Protection Program

US Mortgage Lenders Are Starting to Go Broke - BNN Bloomberg

de

por adulto (o preço varia de acordo com o tamanho do grupo)