Useful Life Definition and Use in Depreciation of Assets

Por um escritor misterioso

Descrição

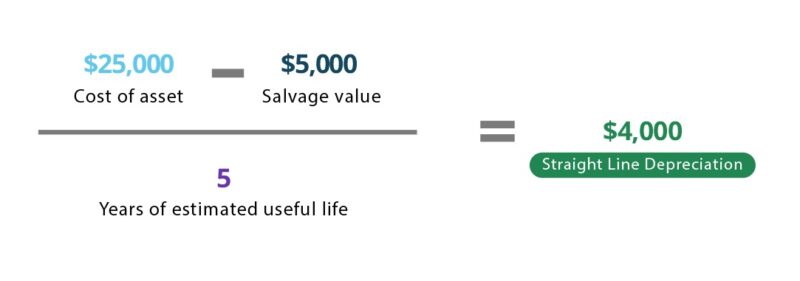

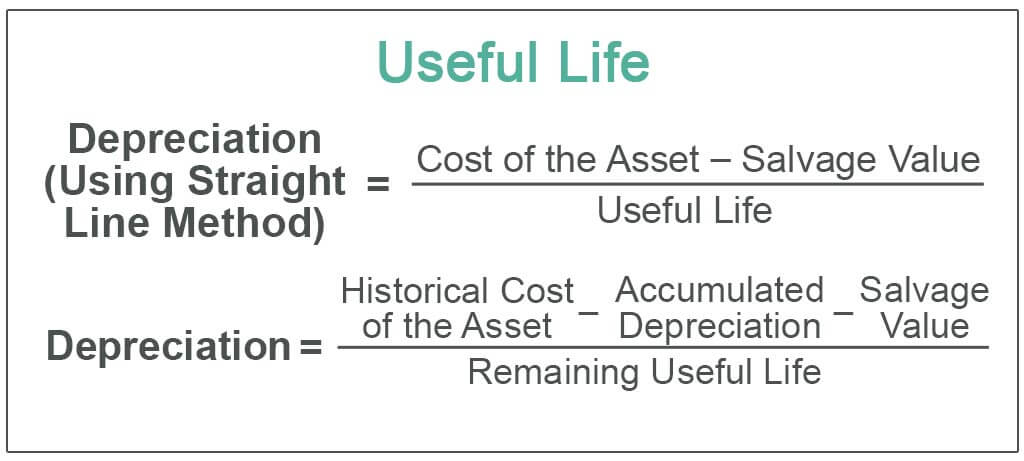

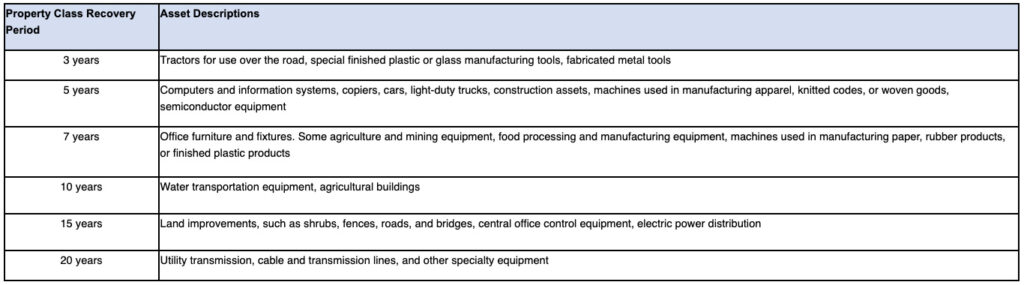

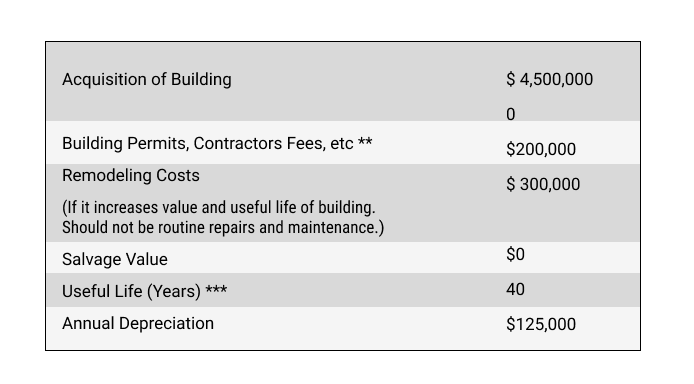

The useful life of an asset is an estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.

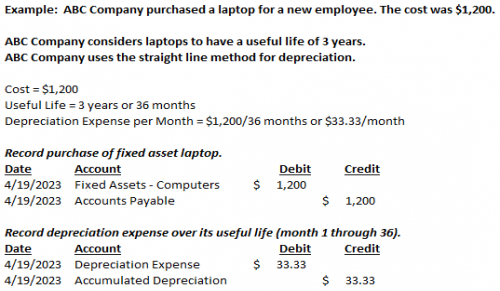

Depreciation, Example & Meaning

8 ways to calculate depreciation in Excel - Journal of Accountancy

Depreciation Methods - 4 Types of Depreciation You Must Know!

Useful Life - Definition, Formula, Example

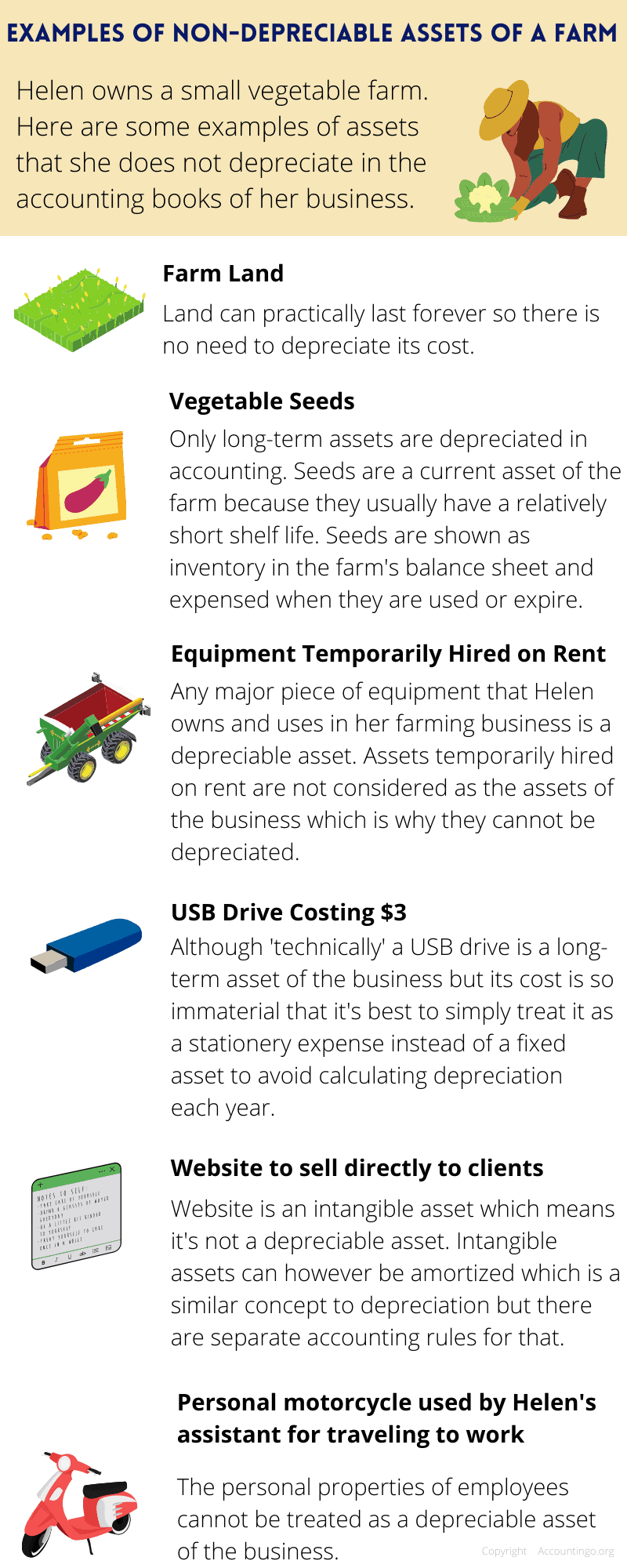

Assets that Can and Cannot Be Depreciated

Depreciation method used in France at the governmental level

Depreciation - Selling a Depreciable Asset

Fixed Assets Nonprofit Accounting Basics

%20formula.png)

Amortization vs. depreciation:Explained

Asset Lifespan: How to Calculate and Extend the Useful Life of Assets

What Is Depreciation? and How Do You Calculate It?

The Basics of Computer Software Depreciation - Common Questions Answered

Useful life: Understanding How Useful Life Impacts Depreciated Cost - FasterCapital

Is Depreciation an Operating Expense? - Akounto

Depreciation for Nonprofits: An often neglected, but essential noncash expense for nonprofit organizations - Community Vision

de

por adulto (o preço varia de acordo com o tamanho do grupo)