How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Descrição

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Clean vehicle tax credit: The new industrial policy and its impact

:max_bytes(150000):strip_icc()/6-ways-to-write-off-your-car-expenses.aspx-Final-97003f07090546d99b4e2cf41c552cbd.jpg)

6 Ways to Write Off Your Car Expenses

Every electric vehicle that qualifies for US federal tax credits

Tesla Vehicles Eligible for $4,000 Used EV Tax Credit - Kelley Blue Book

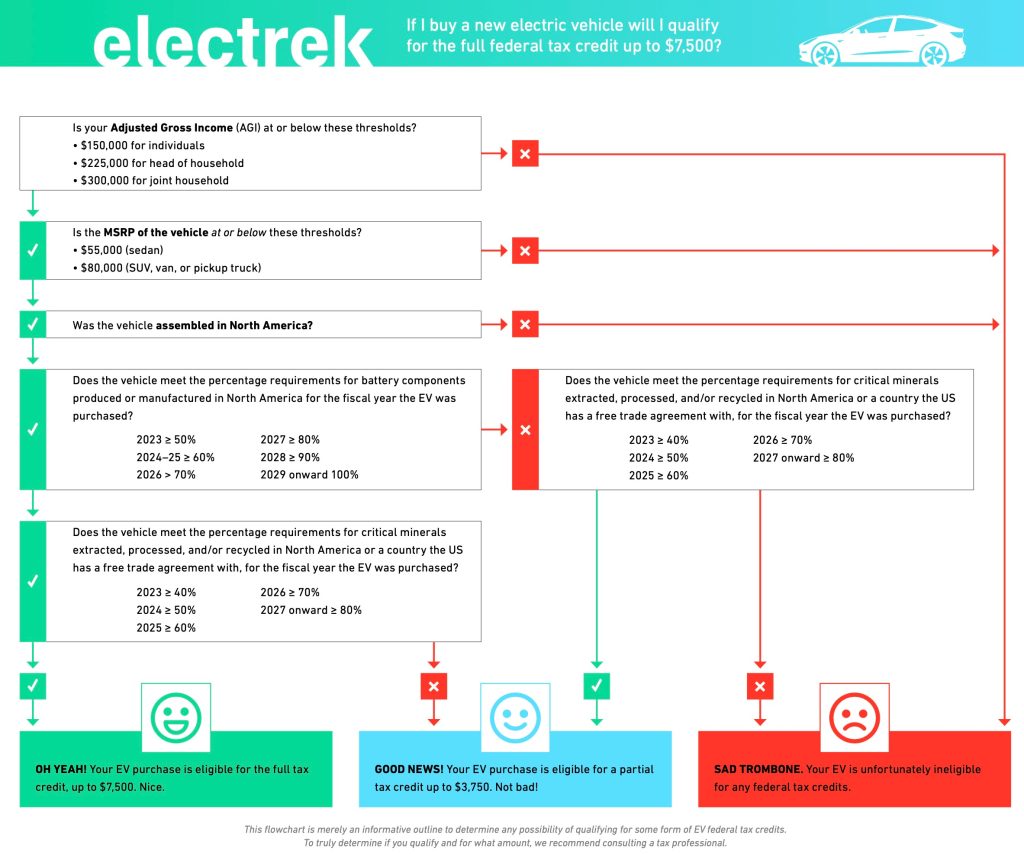

How the EV Tax Credit Works: Income Limit and Which Vehicles Qualify

Electric Vehicle Tax Credits

Introducing The Commercial Clean Vehicle Tax Credit

Every electric vehicle that qualifies for US federal tax credits

How to Qualify for an EV Tax Credit

Here are the cars eligible for the $7,500 EV tax credit in the Inflation Reduction Act in 2023

de

por adulto (o preço varia de acordo com o tamanho do grupo)