High-Low Method Definition

Por um escritor misterioso

Descrição

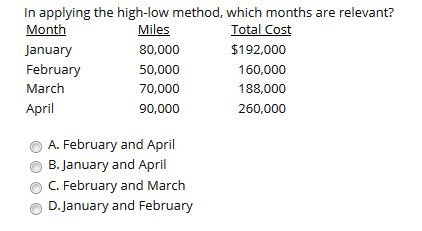

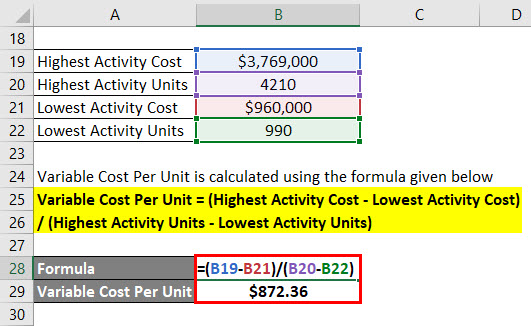

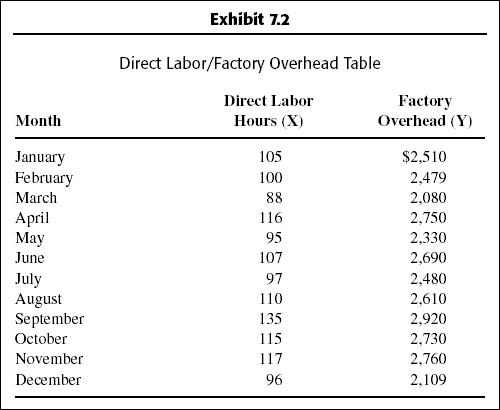

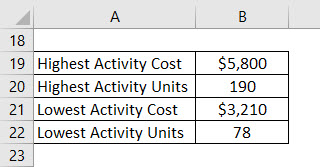

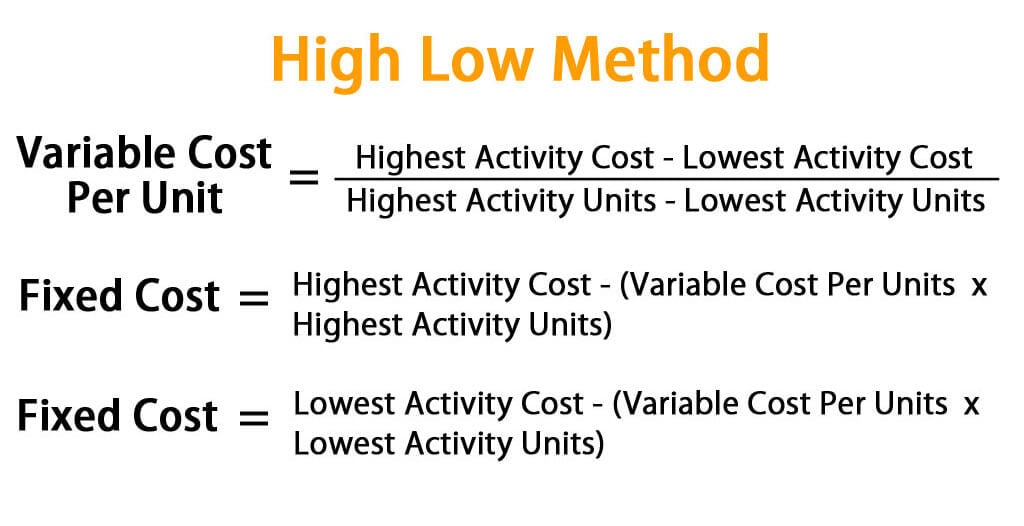

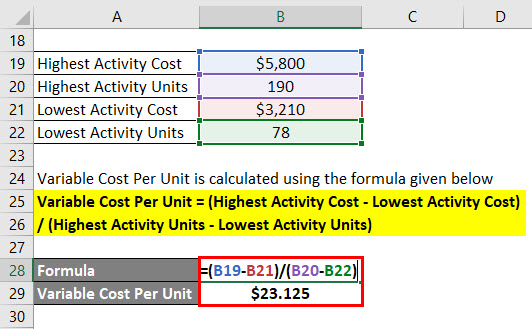

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

:max_bytes(150000):strip_icc()/terms_c_cost-volume-profit-analysis_Final-c64baee383cd4154b5fc2715e3e1dbb7.jpg)

High-Low Method Definition

High-Low Method in Accounting - FundsNet

AES E-Library » The Fast Local Sparsity Method: A Low-Cost Combination of Time-Frequency Representations Based on the Hoyer Sparsity

Solved In applying the high-low method, which months are

High-Low Method Formula - What Is It, Examples, Calculation

High Low Method Accounting Simplified

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

High-low Method - Budgeting Basics and Beyond [Book]

High-Low Method in Accounting - FundsNet

Cost variance: Managing Cost Variance through the High Low Method - FasterCapital

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

High Low Method Accounting Simplified

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

de

por adulto (o preço varia de acordo com o tamanho do grupo)