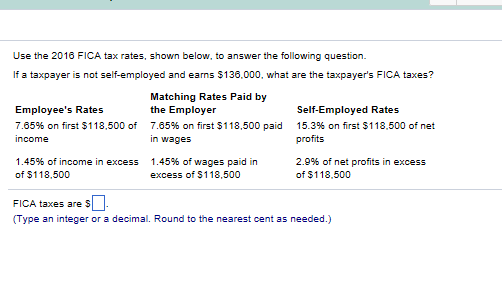

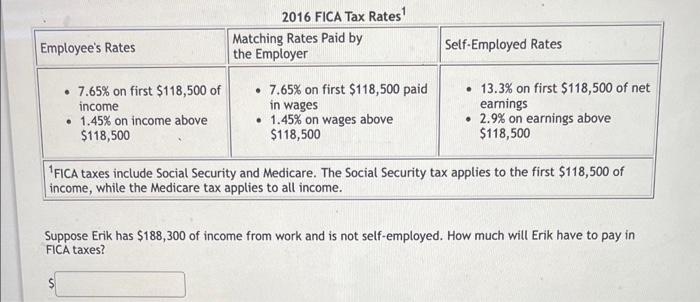

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social

Por um escritor misterioso

Descrição

Answer to Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social

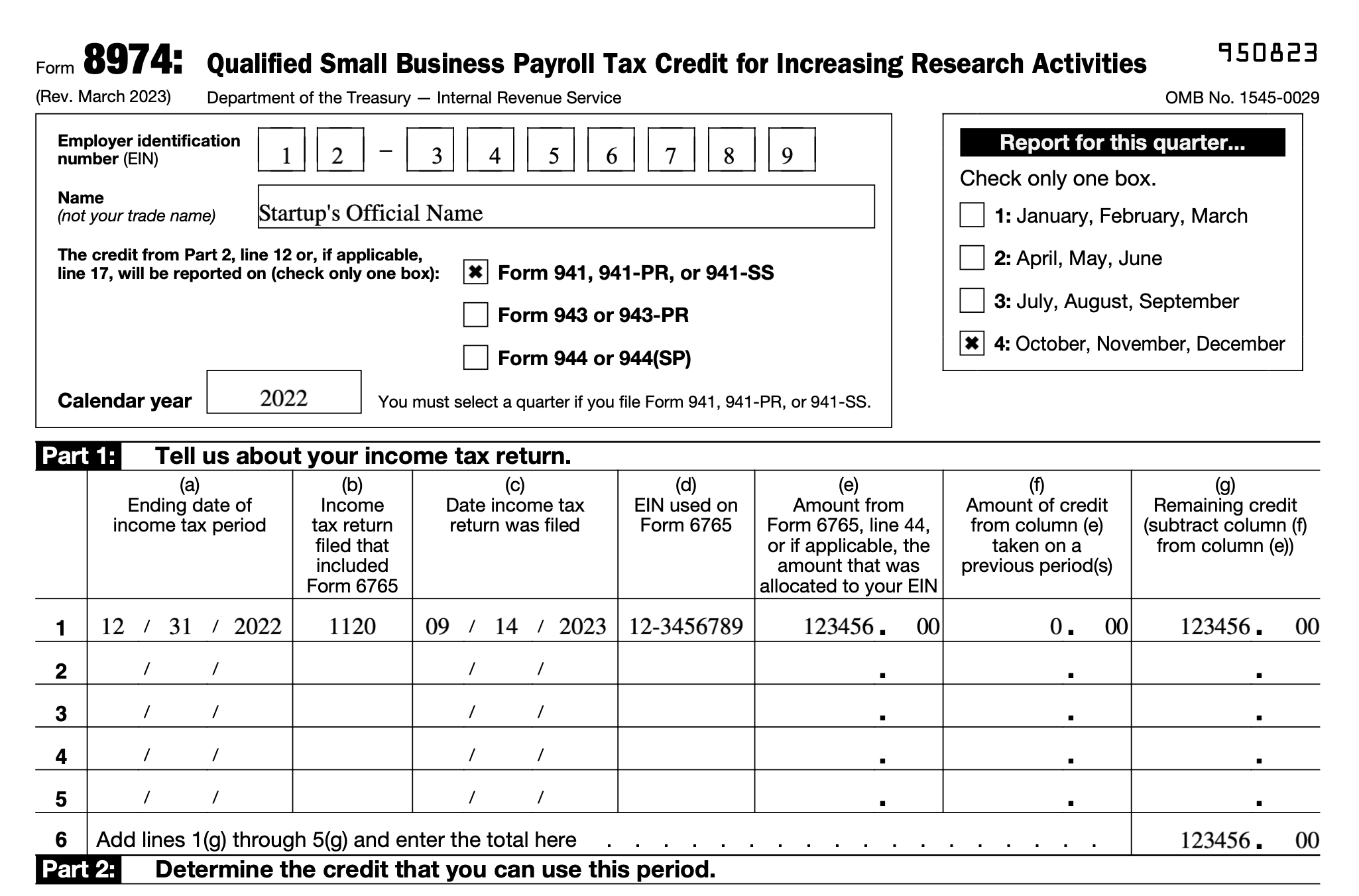

How to claim your R&D tax credit

Solved] Assume a tax rate of 6.2% on $118,500 for Social Security and 1.45%

Highest U.S. Marginal Tax Rate is Too Damn Low : r/Economics

How do taxes affect income inequality?

Solved Use the 2016 FICA tax rates, shown below, to answer

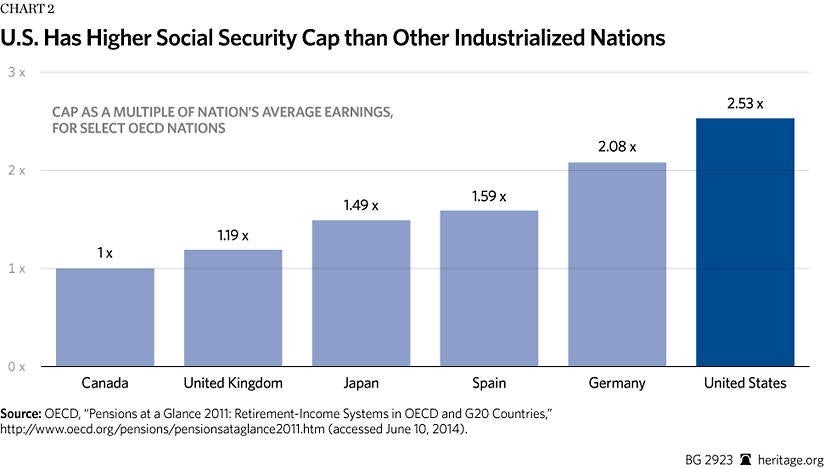

Making Millionaires Pay Their Fair Share: Part 2 of 2

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much

Overview of FICA Tax- Medicare & Social Security

Small Business Payroll Taxes: How to Calculate and How to Withhold

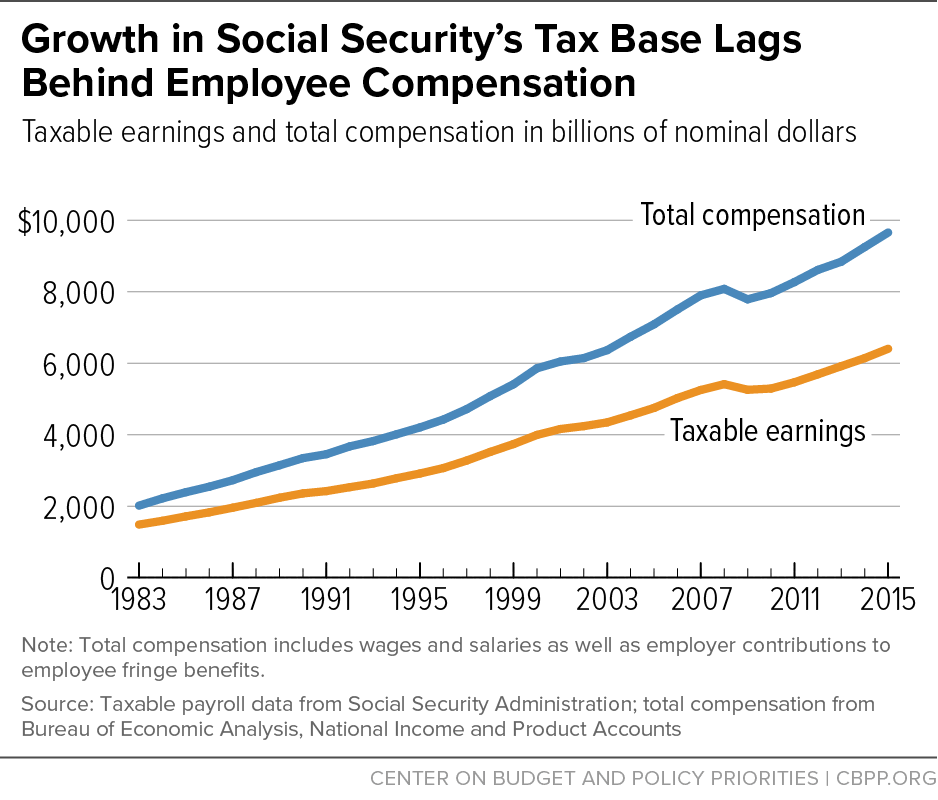

Increasing Payroll Taxes Would Strengthen Social Security

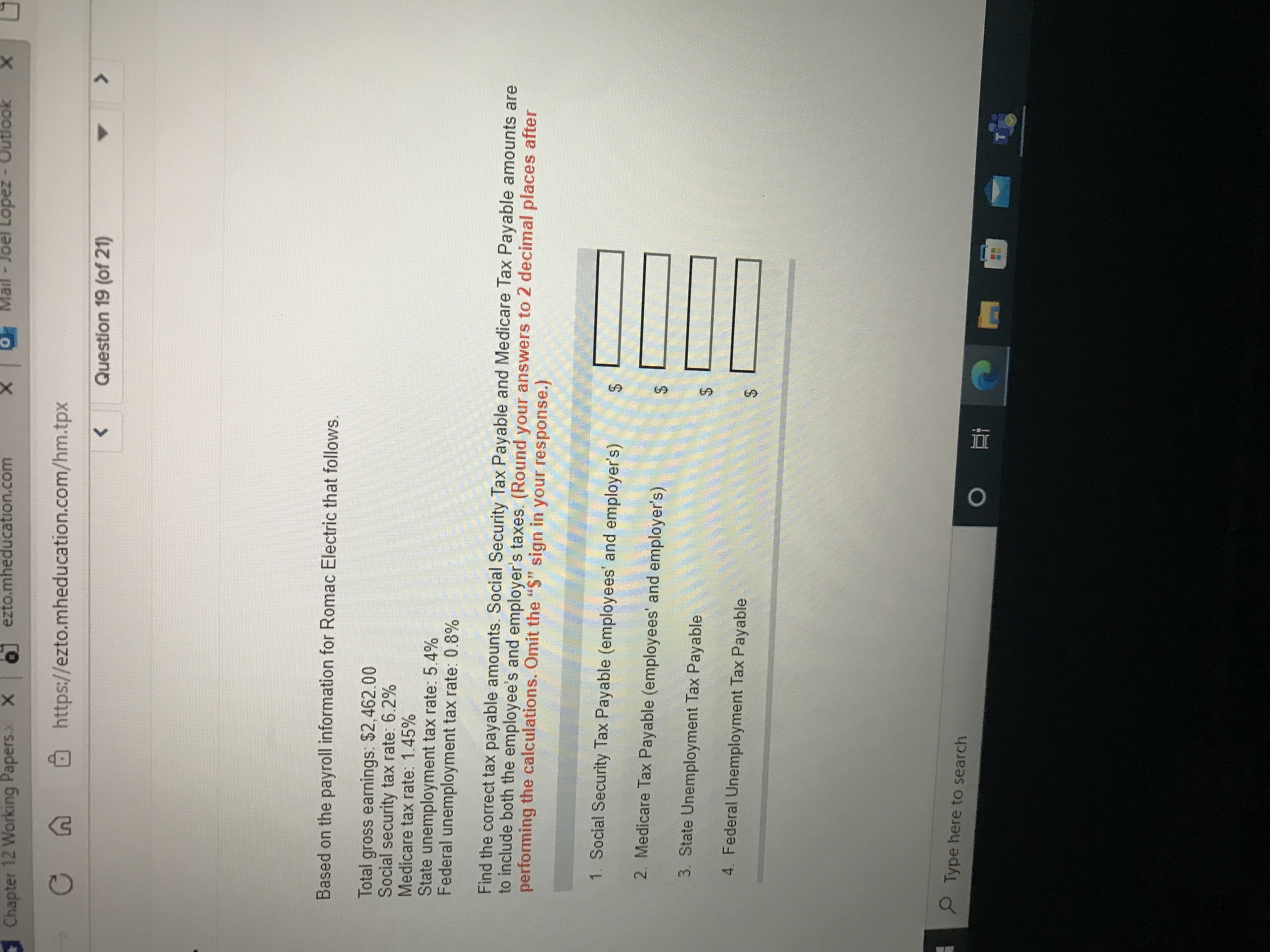

Answered: %24 %24 %24 xoon Mail - Joel Lopez -…

Solved 1 FICA taxes include Social Security and Medicare.

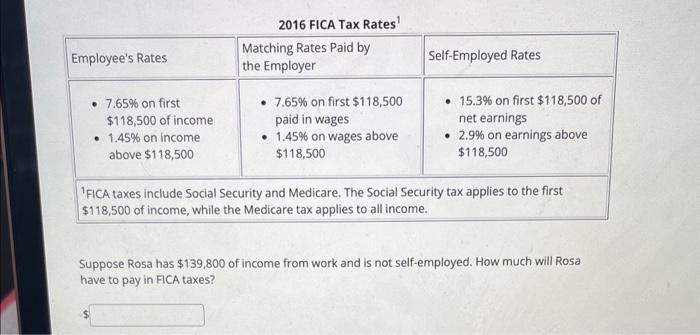

Solved 2016 FICA Tax Rates 1 Suppose Rosa has $139,800 of

Taxes – Payroll taxes, especially Social Security, are regressive … NOT !!!

de

por adulto (o preço varia de acordo com o tamanho do grupo)