Open-Ended Fund: Definition, Example, Pros and Cons

Por um escritor misterioso

Descrição

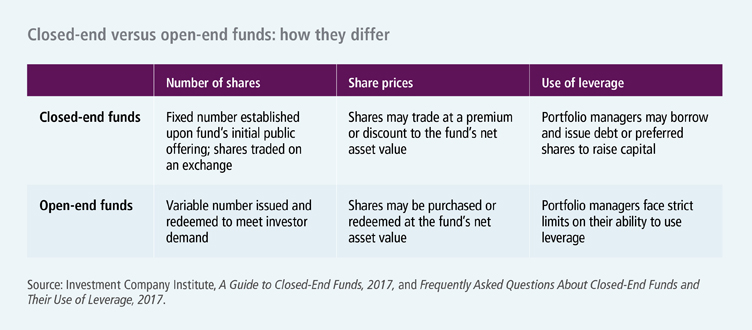

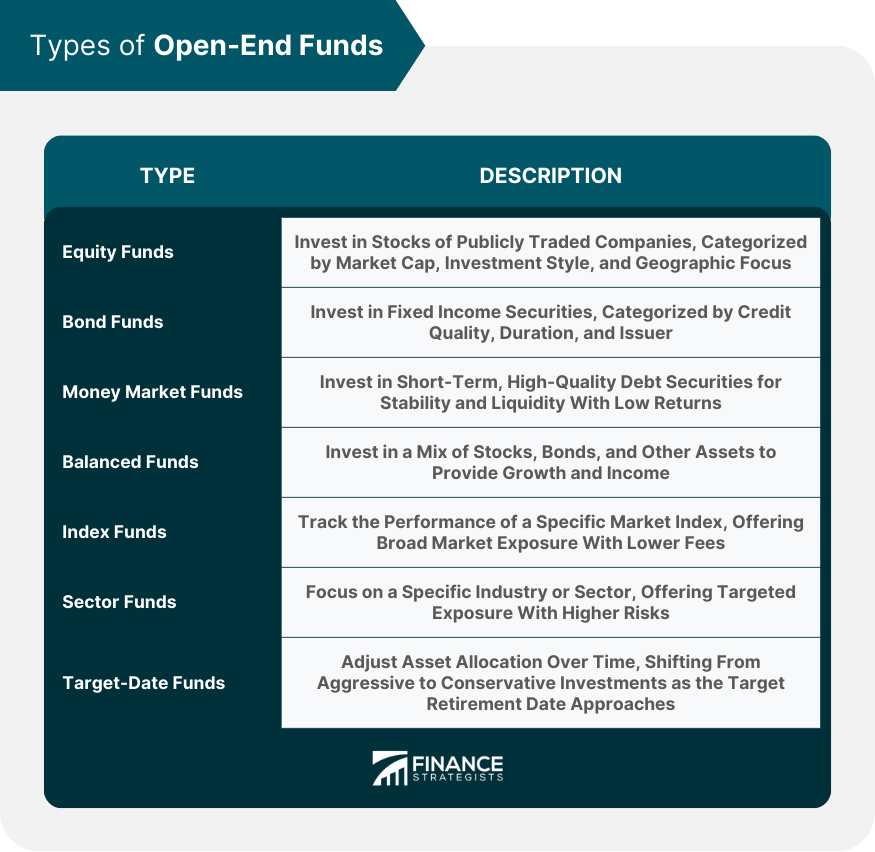

An open-end fund is a mutual fund that can issue unlimited new shares, priced daily on their net asset value. The fund sponsor sells shares directly to investors and buys them back as well.

What are closed-end funds?

Closed vs. Open-Ended Funds: Which one do I pick? - Personal

Financial Derivatives: Definition, Pros, and Cons

Franchise: (Definition, 14 Examples, Pros & Cons)

After-Hours Trading: How It Works, Pros & Cons, Example

:max_bytes(150000):strip_icc()/bdc.asp-Final-6c4e490db7bb494194b4777023761e3a.jpg)

Business Development Company (BDC): Definition and How to Invest

Open-End Funds vs. Closed-End Funds - SmartAsset

Open-End Fund Definition, Types, Pros, Cons, and Pricing

Open-end Mutual Funds - Overview, Net Asset Value, Pros and Cons

Types of Mutual Funds in India: Based on Risk, Asset Class, Goals

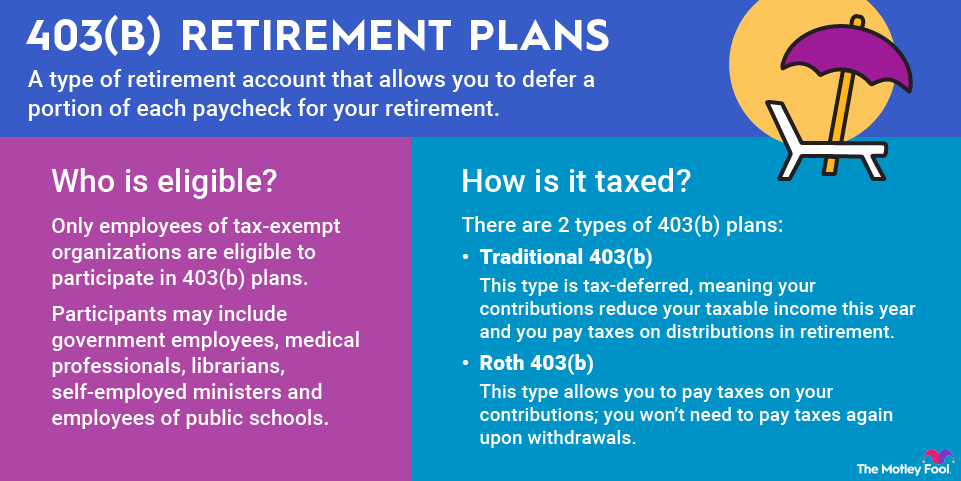

403(b) Plan: How it Works and Pros & Cons

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/posters-we-re-open.jpg.jpg)